In a big international company like Transcom, there is a huge volume of intercompany transactions. These operations have a relevant impact in the accounting, taxes and legal reports in each country. They require clear and detailed rules, which frequently need to be explained to the tax authorities, meaning an important effort in data collection.

Also, the intercompany process play a very significant role in the financial consolidation, to ensure that internal operations are reconciliated and have no impact in the group results.

Last year, Transcom decided to invest in an ambitious project, in order to achieve a full automation of the intercompany flows and intercompany reconciliation in the entire group.

The main targets of this project were:

- Harmonization of the intercompany process, involving all possible intercompany flows

- Creation of an automation platform to simplify the maintenance of the intercompany rules and distribution keys, as well as the execution of the global process

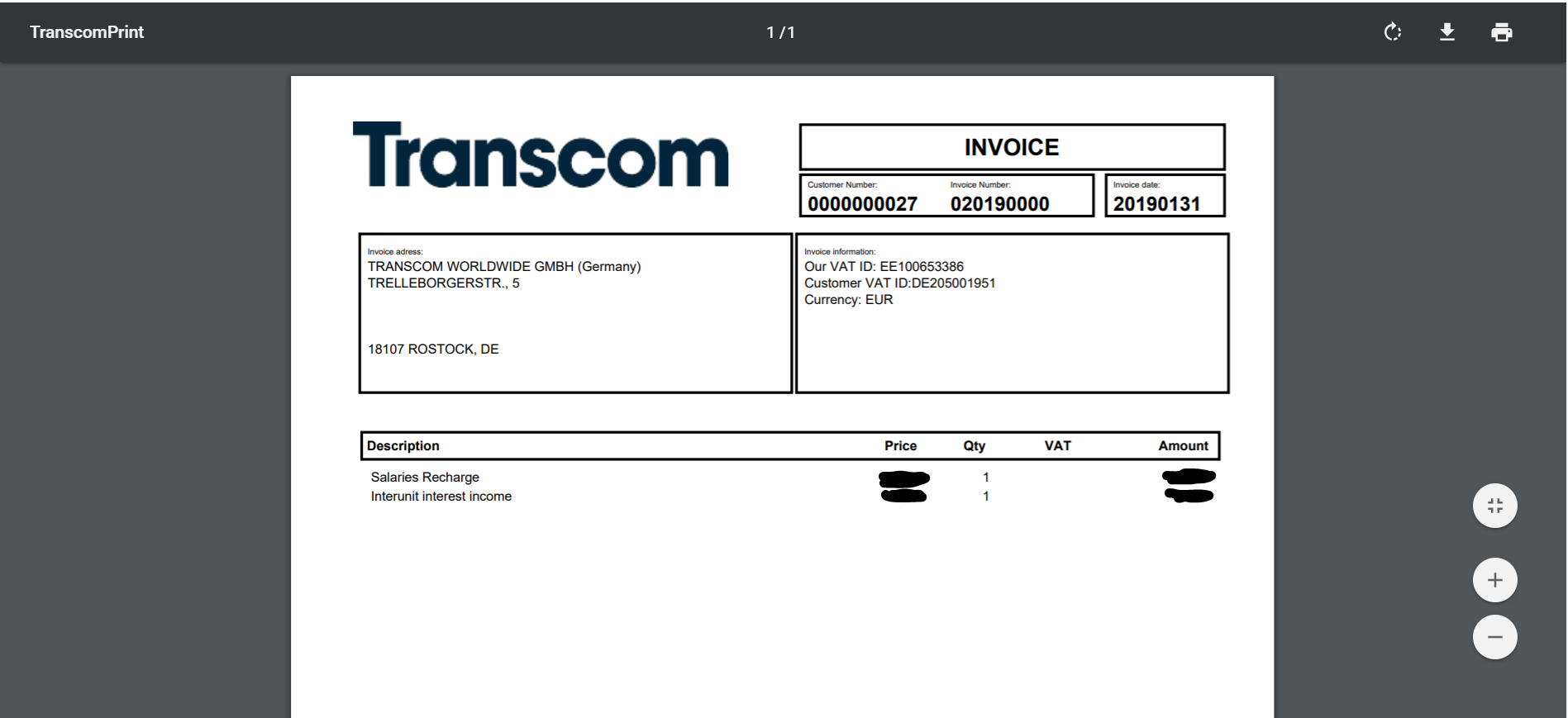

- Provision of a clear and efficient procedure to retrieve the intercompany invoices as well as the calculations and documents involved, to facilitate the audits.

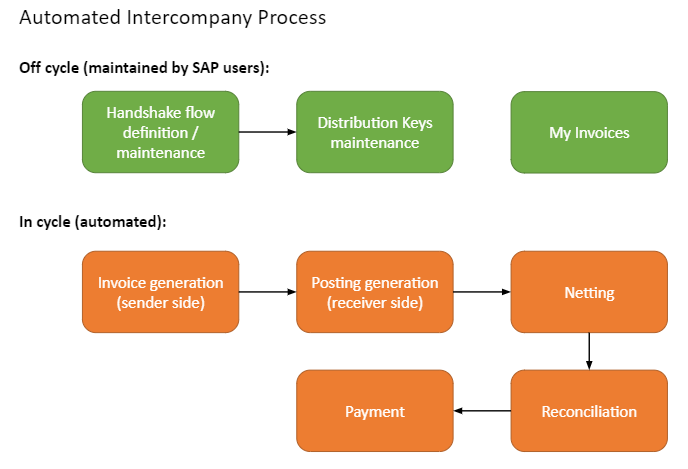

The harmonized process is described in the following chart:

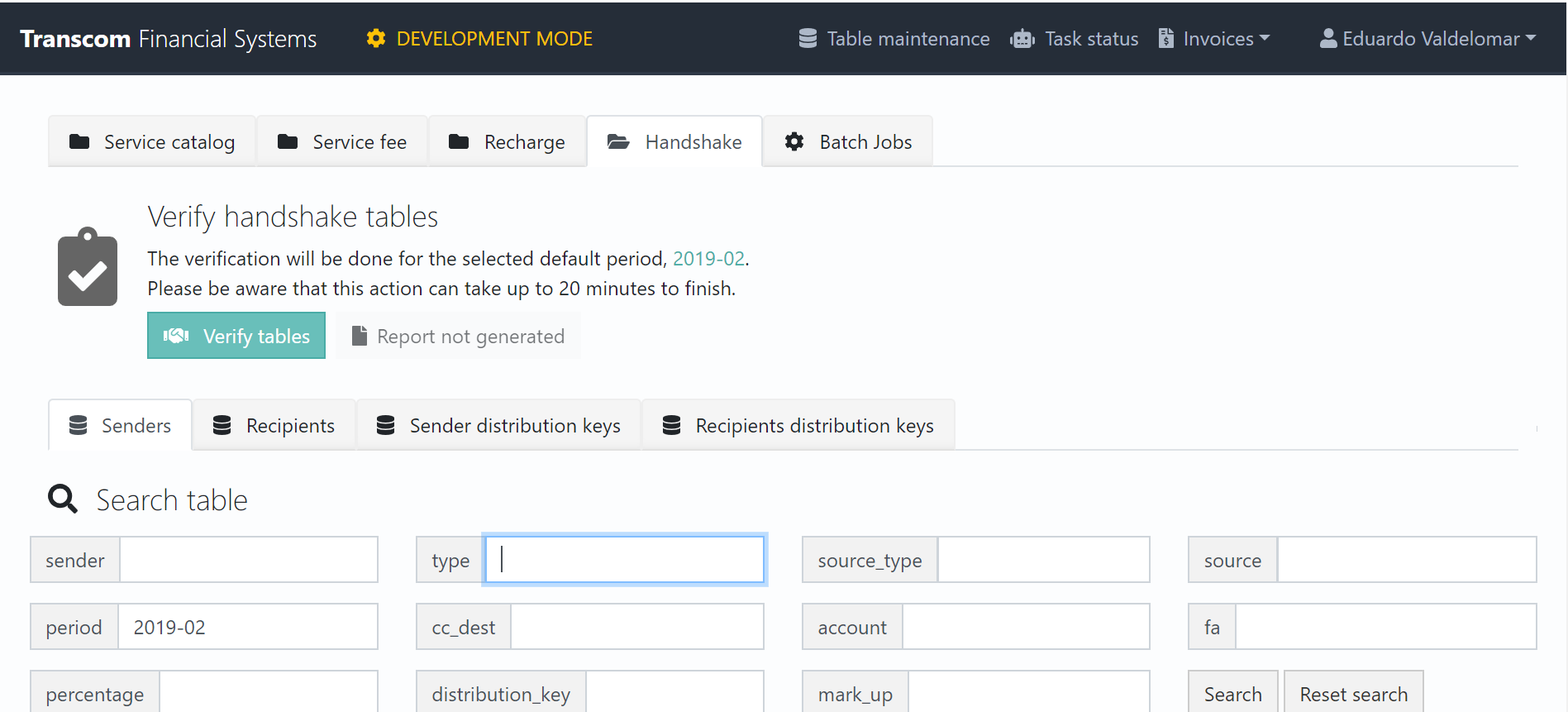

The off-cycle part of the process defines the flows that will generate the individual transactions. It is named “handshake” as the sending entities and the receiving entities must agree about what are they going to invoice each other’s.

There are different types of intercompany operations (subcontracting, administrative services, shared service centers…) and each one has its own rules and requires different information in order to define the flows.

In some cases, a service needs to be invoiced to different entities, so it is necessary to define the distribution rules (e.g. a specific IT fee must be distributed based on the number of licenses used in each company). These distribution keys are also registered within the handshake process. Finally, a check process validates that the flows defined are consistent before the cycle is executed.

Once all flows are set and the distribution keys are defined, the automated cycle is able to generate each month all the intercompany transactions without any human intervention. The documents are generated in SAP ECC with the complete information about sources and calculations attached to each SAP document. The way the transactions are executed in SAP grant an immediate reconciliation during the consolidation process, and make possible an easy netting and payment cycle.

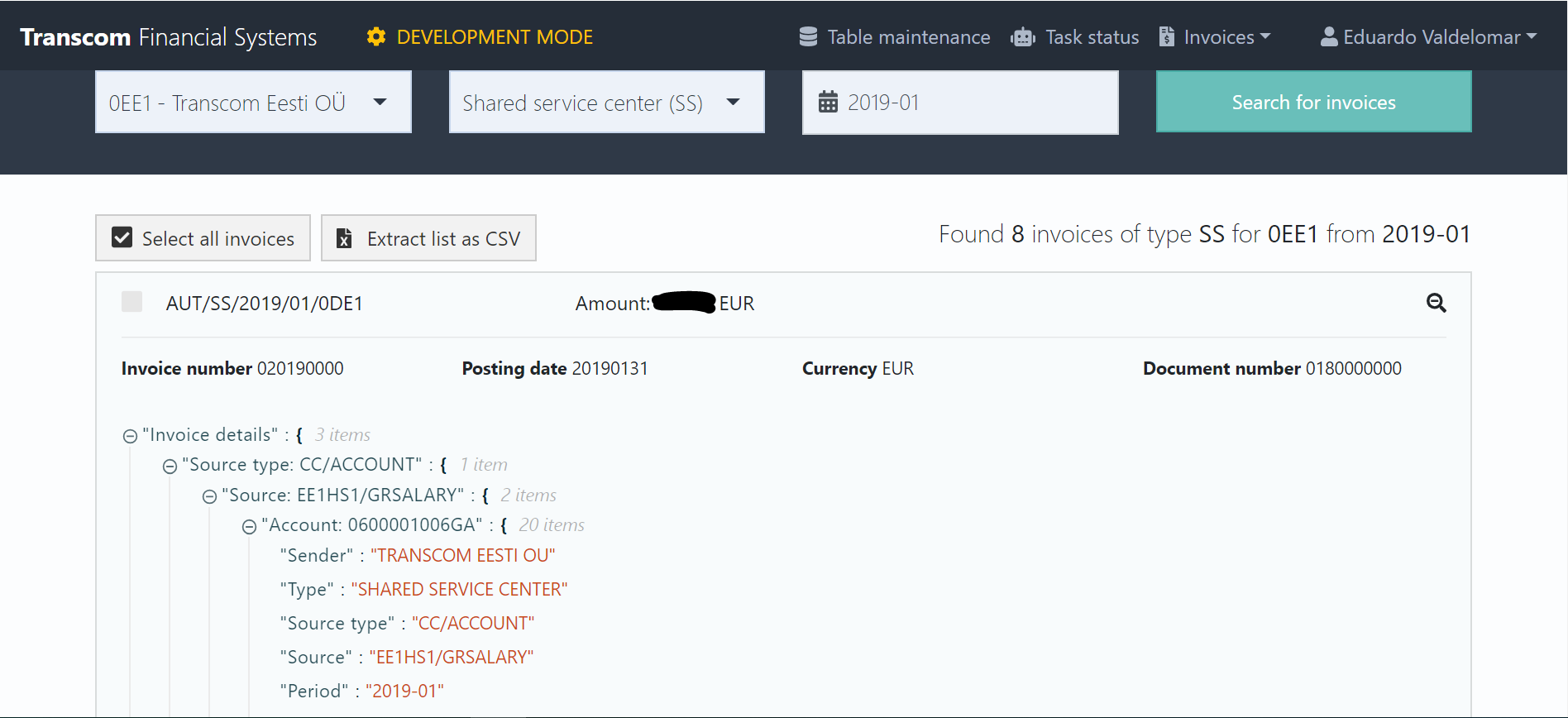

Finally, and also a part of the off-cycle process, the portal “my invoices”, where Financial and Tax teams can review the intercompany invoices and retrieve the full information used to do the calculations.

The project started in September 2018 under the sponsorship of the Global CFO, and was lead by the Financial Systems department with the cooperation and support of the departments of Financial Controlling, Business Controlling and Taxes, as well as the local financial teams. The first execution of the new automated process happened in the closing of January 2019, covering 80% of the intercompany transactions. The second phase of the project is ongoing, with the objective to cover the 100% of the transactions, as well as the netting and automatic payment.